Medium-Term Management Plan

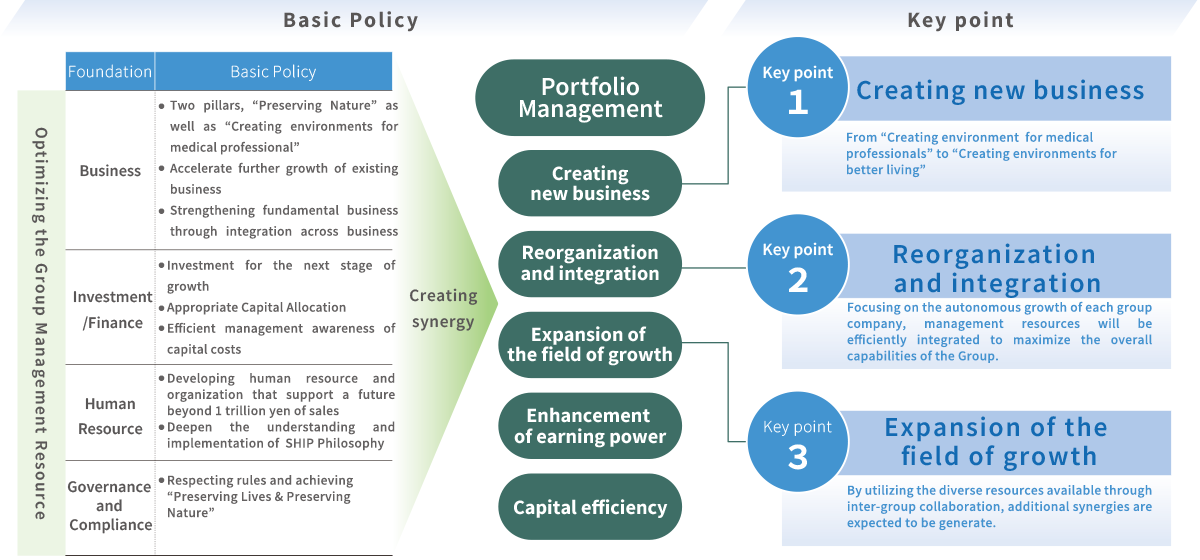

Basic Policy Key point

Key point 1.Creating new business

Key point 2.Reorganization and integration

Key point 3.Expansion of the field of growth

Financial and Capital Strategies

New five-year Medium-Term Management Plan

(FY ending March 2026 to FY ending March 2030)

“SHIP VISION 2030”

(Formulated on May 13th, 2025)

Formulated a new medium-term management plan in anticipation of a drastic change in the business environment

The Group has grown through generally providing the best solution specialized in 5 fields “Medical”, “Healthcare”, “Welfare”, “Nursing care”, and “Services” with the Group mission “Creating environments for medical professionals” through “SHIP” philosophy from its foundation. We are now launching our new growth strategy under the five-year medium-term management plan, “SHIP VISION 2030”. In this plan, we aim for creating new business including “Well-Being” field, more efficient management through reorganization and integration of Group companies which increase via M&A and further enhancement of Group synergy as well as the growth of existing businesses. Furthermore, to reinforce our financial and capital strategies, we will go beyond our existing commitment to maintaining a dividend payout ratio of 30% or more. We are establishing a clear capital allocation policy, enhancing the transparency of growth investments and shareholder returns.

Quantitative Targets

Basic Policy Key point

Key point 1.

Creating new business

From “Creating environments for medical professionals” to “Creating environments for better living”

Promoting Well-Being

In line with our Group mission of “Creating environments for medical professionals.” we have traditionally focused on domains related to “Preserving Lives”. We further expand the way of capturing the field and expand it to the field of “Creating environments for better living.”

Selected as the designated operator (Park-PFI system*) for Esaka Park and Esaka Library in Suita City, Momoyama Park enhancement project, and Nakanoshima Park & Nakanoshima Sports Ground, and entrusted with management operations.

*Park-PFI system: A public offering installation management system for public return type profit facilities by private business operators.

Entrusted with facility management work for a total of 84 facilities, including elementary schools, junior high schools, kindergartens, and nursery schools owned by Suita City.

*Business period: October 1st, 2023 – March 31st, 2028

Key point 2.

Reorganization and integration

Focusing on the autonomous growth of each group company, management resources will be efficiently integrated to maximize the overall capabilities of the Group.

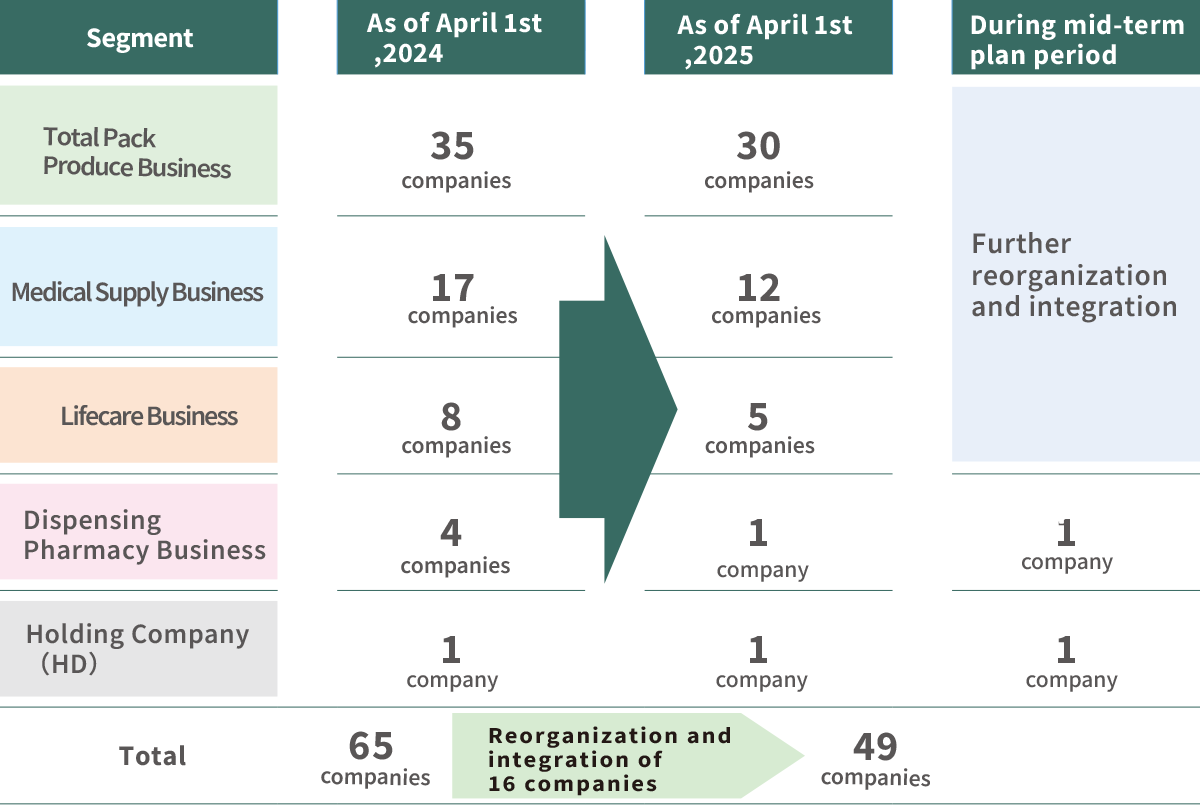

Further Promotion of Group Reorganization and Integration

We have engaged in aggressive internal Group reorganization and integration to be the leader Group in the Japanese healthcare industry under the severe business environment. As a result, as of April 1, 2024, 16 out of 65 Group companies had been successfully integrated, with the nursing care and pharmacy-related businesses consolidated into a single entity respectively. We continue to advance reorganization and integration to further enhance the promptness of management and to further utilize management resources efficiently during the period of the new medium-term management plan.

Especially within Medical Supply Business, facing intensifying price negotiations due to hospital management challenges and growing efforts by manufacturers to centralize distribution, we will deepen our business operations while enhancing cooperation and synergy with other segments such as Total Pack Produce Business.

Next-generation Logistics Initiative

In Medical Supply Business, we have made efforts for automation and efficiency of logistics of medical consumables by RFID in Osaka Solution Center. To address the increasing shortage of labor and limited in-hospital space, especially rising demand for off-site SPD* solutions, we will invest in a new automated warehouse in the Tokyo metropolitan area, about 1.5 times the size of our existing facility. This initiative will further differentiate us from competitors and establish our position as a nationwide, fully integrated healthcare trading company, becoming the partner of choice for both clients and manufacturers.

* SPD(Supply Processing and Distribution)is the system for logistics management in hospitals on behalf of hospitals.

5 points of the logistics initiative

- Logistics reform to address future labor shortages Improving operational efficiency through workforce centralization and automation

- New procurement strategy Strengthening collaboration with manufacturers through inventory optimization and logistics improvements leveraging operational bases

- Group brand strategy tailored to meet diverse customer needs Capable of supporting bundled contracts with multiple hospitals under different management bodies

- BCP initiatives Establishing systems to ensure stable supply of medical materials

- Emerging demand for off-site solutions due to space constraints within hospitals As in-hospital SPD requires significant space, expanding business opportunities by capturing external SPD needs

Key point 3.

Expansion of the field of growth

By utilizing the diverse resources available through inter-group collaboration, additional synergies are expected to be generated.

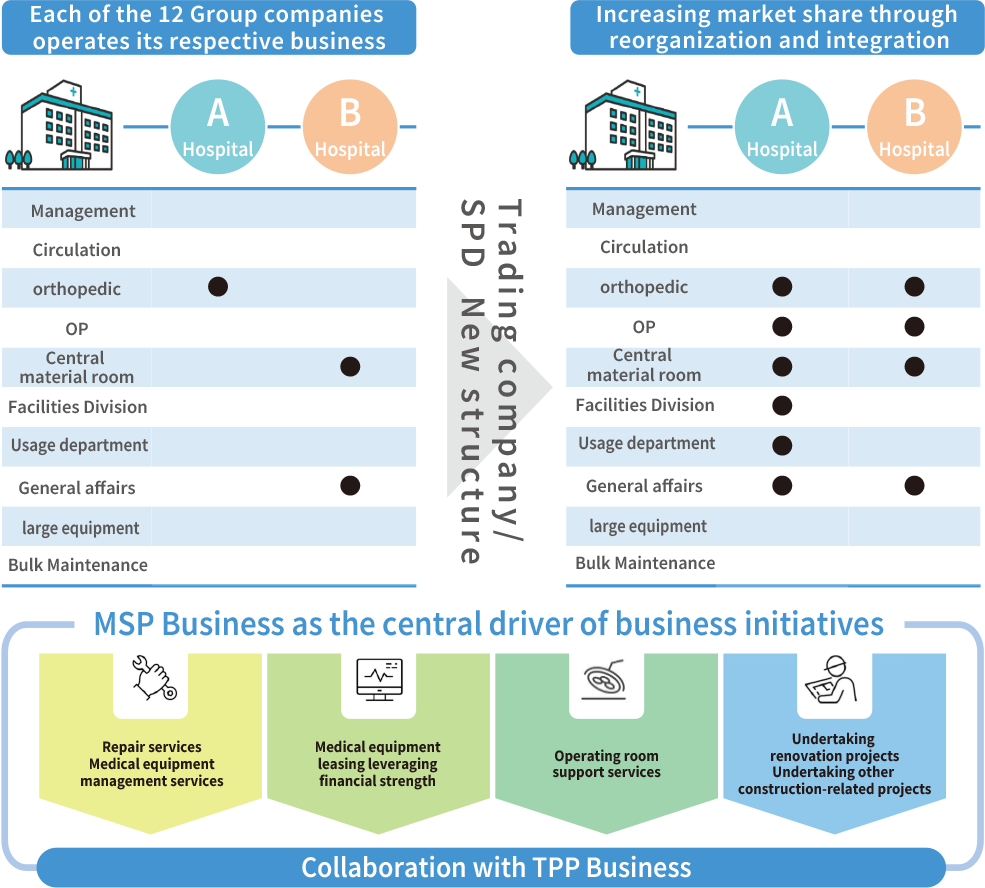

Business Development Initiated from MSP Business

Personnel and materials expenses account for approximately 80% of hospital expenditure, making their management a critical issue in hospital operations. Medical Supply Business, being deeply integrated with daily hospital activities, allows us to offer detailed operational improvement proposals, IT support, and comprehensive outsourcing services. In addition, we advance reorganization and integration to gather information of various businesses. We set up a system for expanding this information to other segments including Total Pack Produce Business. We will expand this segment further, while simultaneously Reorganization to function as a hub for business intelligence. This intelligence will be leveraged across the Group, including in our Total Pack Produce and other segments, to support Group-wide growth and integration.

Financial and Capital Strategies

Stable shareholder return (Dividend increased for 9 consecutive years)

We place strong emphasis on providing stable and sustainable shareholder return alongside business growth. Dividends per share in the FY ended March 2025 were planned to be 53 yen per share initially. However, considering net income exceeding our original forecasts and the confirmation of a reinforced financial foundation, we increased the dividend by 5 yen to 58 yen per share, achieving a dividend payout ratio of 36.2%, thereby delivering even more robust shareholder return. In the FY ending March 2026, we forecast a regular dividend of 60 yen per share. We will continue appropriate allocation of results based on performance under the basic policy of stable maintenance of 30% or more of payout ratio as well as securing retain earnings which is needed for future business expansion and further enhancement of management foundation. We will remain committed to enhancing long-term corporate value and meeting shareholder expectations.

Consolidated payout ratio: 30% or more

Dividend increased for 9 consecutive years

| FY03/22 | FY03/23 | FY03/24 | FY03/25 | FY03/26(Plan) | ||

| Dividends per shareVT(yen) | Ordinary dividends | 41 | 42 | 45 | 58 | 60 |

| Commemorative dividends | ー | ー | 5 | ー | ー | |

| Total | 41 | 42 | 50 | 58 | 60 | |

| Dividends in total (Million yen) | 3,868 | 3,962 | 4,717 | 5,472 | 5,661 | |

| Consecutive payout ratio | 31.8 | 32.8 | 34.2 | 36.2 | 36.5 | |

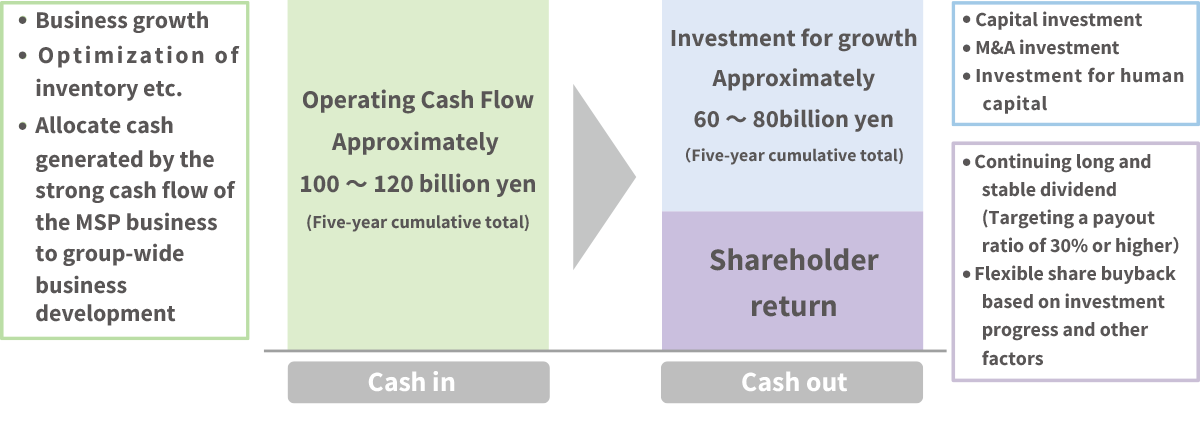

Capital Allocation

We view Cash Flow from operation as the foundation of capital generation and the engine driving our growth. We continue to expand corporate value by challenging new business fields through M&A and capital investment and strengthening competitiveness of existing business. Through this, we will strive to deliver both “enhancing earning power in the future” and “further return to shareholders.”

Agile Acquisition and Cancellation of Treasury Shares

We have positioned “achieving ROE (Return on Equity) of 12%” as a key management targets in the new medium-term management plan and aim to create return which exceeds capital costs.

As a part of the target, we have clear articulated our intent to execute agile acquisition of treasury shares and we plan to acquire treasury shares of up to 5 billion yen/3.3 million shares during the period from June 7 to December 31, 2025. This is expected to contribute to the improvement of Earnings Per Share (EPS) and ROE. In addition, cancellation of 7.31 million of treasury shares was completed on June 30, 2025.

We will continue to balance growth investments and returns to shareholders, while steadily improving capital efficiency and enhancing long-term corporate value.

| Details of acquisition |

|---|

|

1.Type of shares to be acquired: Common shares of the Company 2.Total number of shares that can be acquired: Up to 3,300,000 shares (3.5% of total number of issued shares of the Company (excluding treasury shares)) 3. Total price of shares to be acquired: Up to 5,000,000,000 yen 4. Period of acquisition: From June 7, 2025 to December 31, 2025 5.Method of acquisition: Market purchases on the Tokyo Stock Exchange |

| Details of cancellation |

|---|

|

1.Type of shares cancelled: Common shares of the Company 2.Total number of shares cancelled: 7,319,266 shares (7.2% of total number of shares issued before cancellation) 3. Scheduled date of cancellation: June 30, 2025 |